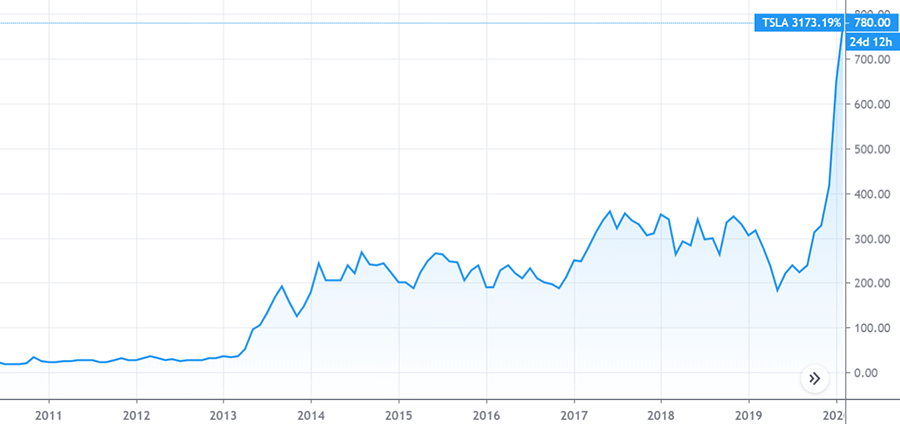

Less than a year ago, things looked bleak for Tesla, when shares dropped below $200. But, in just seven short months, CEO Elon Musk has turned the company into the most valuable US automaker of all time. So, how did the embattled founder get back to delivering the impossible for his shareholders?

2017 and 2018 were largely a trip through hell for Elon Musk and Tesla. Things didn’t work out as planned. The image problems for Musk were compounded by production issues for Tesla. Model 3 deliveries were delayed and the promised $35,000 price tag was never met.

Elon Musk had very ambitious targets to build the Model 3 compact car in California, and it turned out way harder than he expected, in part because of his vision for automation. He talked about an idea of being able to turn the lights off and let the robots do their work. Well, the plan and the vision turned out to be much more complicated than anyone anticipated or at least he anticipated.

Then, on day one of 2019, U.S. customers were hit with an effective price increase to buy any Tesla. The federal tax credit for electric vehicles was cut in half as part of a planned year-long phase out. The company announced it was lowering the vehicle’s price because it was essentially trying to counteract that effective price increase. Some took that as a sign that Tesla perhaps had peaked at the number of customers in the U.S. willing or able to afford that higher price Model 3.

A week later, Tesla started construction of a new factory in China, the country’s first entirely foreign-owned car plant without any local partners. China’s the world’s largest auto market, huge consumer of electric vehicles and luxury vehicles, so, in a lot of ways, a really good place for Tesla to play.

“We’re incredibly excited to break ground on the Shanghai Gigafactory,” says Elon Musk. He promised that, by the end of the year, the factory would be up and running and they would be building cars. That was a remarkable promise to make, and a lot of close auto industry observers really questioned if that was gonna be possible, thinking that perhaps this was yet again another overly ambitious target that Elon Musk was setting for the company and that in reality it would probably take much longer.

First quarter sales were worse than expected, beginning the year with a loss just months after Musk ensured shareholders that Tesla would be profitable every quarter into the future, short of a disaster. Analysts looked at it, and they really began to wonder what the demand level was like here in the US.

Some of the older vehicles, like the Model S and the Model X had been the underpinning of the company’s business, and if demand was falling off for those vehicles, that would raise questions about the financial house that Tesla had built.

The stock continued to fall, and in early June Tesla closed at just under $179 per share, the company’s lowest closing price of 2019. So the third quarter, we’re starting to see the fruits of Tesla’s labor. They’ve been working to get the Model 3s to Europe and into China.

And a turning point for Tesla in 2019 was really the announcement of a surprise profit, and the company started looking like, well, maybe they are on the right track and a return to a story of potential growth.

At the end of November, Musk revealed Tesla’s long-awaited Cybertruck, the world’s first electric pickup truck. Doesn’t look like anything else. As the event began to unfold, they were talking about features that really you don’t normally talk about in a new car such as windows that were bulletproof.

And so, onstage, Elon and his people were making a demonstration of this, and they got these metal balls. They throw the balls at two windows, breaking both of them. This is unheard of, that you normally don’t see a CEO onstage with such a colossal demonstration gone awry.

So the next day, you might think the stock might go down, but in fact you’re seeing huge conversations about this vehicle. Just days later, Musk tweeted that more than 250,000 people had placed pre-orders for a Cybertruck. From there, something interesting happened. It returned the conversation to the future of Tesla. It was always what had they done today and why were they struggling to get these cars out, and what Musk had been able to do is put the conversation yet again to this new vision of what he was promising for personal transportation.

Exactly a year after breaking ground at the Shanghai factory, Tesla held a press conference to announce their first deliveries of China-made Model 3s to Chinese customers. The car maker also confirmed it had met another of Musk’s seemingly impossible goals: delivering at least 360,000 electric vehicles in 2019. The surprise here was that Elon delivered on what he’d promised, something that he’d struggled in the past, but here he was executing, something that really enthused investors, because if he could deliver on these promises, what other promises could he deliver on?

Tesla just reported another profitable quarter, but the future is still uncertain. The company has yet to deliver a full-year profit, and it’s unclear how long success in China will last. The entire Chinese car market has been falling steadily for two years, and demand for electric vehicles has declined for the past few months.

There’s still a question about whether Tesla got into China a little bit too late, if the party might be over, so one of the things that Tesla’s gonna face here in the coming months is, what’s the demand for its vehicles?