Despite a significant recovery in April, the outlook for the Chinese car market is bleak. The Chinese manufacturer association CAAM (China Association of Automobile Manufacturers) assumes that sales in China could collapse this year by up to 25 percent, as announced on Monday in Beijing. If the corona pandemic can be contained, a decrease of around 15 percent is expected, it said. If the CAAM forecast is correct, the world’s largest car market would shrink for the third year in a row in 2020.

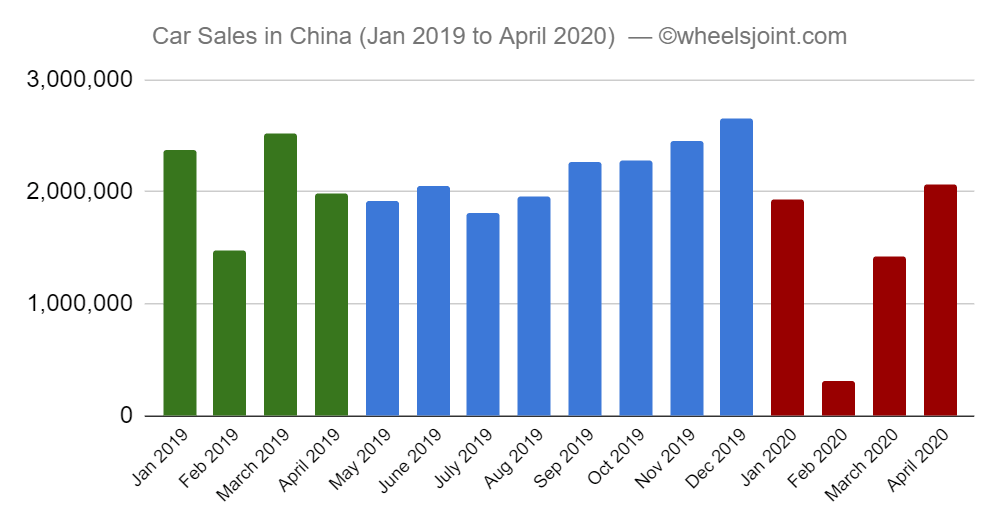

The Chinese auto market collapsed in February due to the Corona crisis. The effects of the pandemic were also clearly felt in March and the numbers fell sharply. Now that a recovery has started, there may be further declines in the coming months, said the industry association PCA (China Passenger Car Association). However, the rapid return of demand suggests a quick recovery in business in China.

A few months after the outbreak of the pandemic, the trend is clearly pointing upwards. According to PCA data, sales were still down in April. However, with a decline of 5.5 percent to 1.46 million cars, SUVs, minivans and smaller multi-purpose vehicles, the minus was significantly lower than in the previous months. In February there was a sharp collapse of almost 80 percent, in March the decline was still 40 percent.

According to CAAM figures, the development is even more positive. According to this, car sales in the Chinese market in April still fell slightly by 2.6 percent to 1.54 million vehicles. Including other vehicle types such as trucks and other commercial vehicles, sales have already increased by 4.4 percent to 2.07 million vehicles. The CAAM measures the sales of the manufacturers to dealers, the association PCA counts the sales to end customers.

The numbers give reason for cautious optimism. The world’s largest car market could start to catch up. Especially since the Chinese government has taken various measures to revive the poor auto industry. In the wake of the Corona crisis, many factories were closed and car dealerships had closed their doors for a long time.

This exacerbated the already existing lull on the Chinese car market. Because of the trade dispute with the United States and the deteriorating economy, China’s car market has been weakening for almost two years. Among other things, the market suffered from the continued reluctance of buyers.

China is the most important single market for the German car groups Volkswagen, Daimler and BMW. The development there after the lockdown could be an indication of how buying behavior and the markets in Europe and North America are developing after the Corona crisis. The world’s largest carmaker Volkswagen recently announced that the group could see a recovery in demand on the Chinese market. BMW had, however, been very cautious about the rapid recovery in Europe and North America based on the Chinese model.

Currently, the markets in Europe and North America are almost in free fall, as the effects of the pandemic compared to China have been delayed and the factories in Europe, the USA and Mexico are only gradually starting up again.

Electrification

BMW

The products make a good impression. When it comes to e-mobility, BMW is not going the same way as VW. Because of the size, BMW doesn’t have the financial options either. However, BMW is characterized by a high degree of flexibility. The share was briefly sold off according to the Q1 figures. The weak margin and lower investments in important projects such as electro-mobility were not well received. Afterwards, the stock recovered. Upwards, the 52.50 euro mark has to be recaptured. The next stronger resistance in the upward trend is 58.50 euros.

Volkswagen

VW is on the right track. The automobile manufacturer sells every fourth car in China. Regarding the important issues of e-mobility and digitization, VW will invest 60 billion euros in these areas over the next four years. VW boss Herbert Diess has to start the chase towards Tesla. Compared to other European automobile manufacturers, VW is best equipped for the future. The stock took the resistance at 125 euros. The next milestone is 135 euros.