In 2019, although the overall revenue of the global automotive industry increased slightly, operating profit declined year-on-year.

According to official financial data from 28 mainstream auto manufacturers around the world, the operating profit of auto companies began to decline before the outbreak of the coronavirus epidemic. In 2019, the operating profit of the entire global automotive industry fell by 11%.

Felipe Muñoz, an analyst at industry research firm Jato Dynamics, said in a report that although the overall revenue of the automotive industry increased slightly to 1.87 trillion euros ($1.03 trillion) last year, operating profit has decreased from 96.71 billion euros in 2018 ($105.3 billion) to 86.38 billion euros ($94.05 billion). As a result of the increase in income and no increase in profits, the operating profit margin fell from 5.2% in 2018 to 4.6%.

The auto industry had many difficulties before the epidemic

The overall profit decline of the global auto industry stems from some convergence issues in the Chinese, US and European markets. First of all, in the Chinese market, auto companies have been affected by a series of policy reforms in the auto industry, including the introduction of strict “National Six” emission regulations, reduction of subsidies for new energy vehicles and the implementation of an electric vehicle sales quota system. China’s car sales account for 29% of the world ’s total sales and it is the world’s largest car market. It is also a key market for large automakers such as Volkswagen, Honda, GM, Daimler and the BMW Group. Any changes in the Chinese economy may have a global impact. In 2018, China’s auto market sales showed the first negative growth in 28 years; in 2019, China’s auto market fell again, a decline of 8.2%; of which, the annual sales of new energy vehicles also experienced negative growth for the first time in nearly ten years.

In the European and American markets, car sales have also begun to show signs of stagnation after a long period of sustained growth. However, unlike China, Europe and the United States are mature automobile markets, so this level of volatility can be considered within normal limits. However, the increasing regulatory pressure in the European market and the uncertainty caused by the Sino-US trade dispute have made automakers in a difficult situation. In 2019, car sales in China and the United States accounted for 42% of global sales.

In addition, uncertainties in major markets in Asia and the Middle East, including India, Iran, Argentina and Turkey, have also contributed to the decline of the global automotive industry. Last year, car sales in these four countries were approximately 5.1 million, a 21% decrease from 2018. Among them, sales of Tata Motors, India’s largest automaker, fell 23%.

Car company’s financial report overview: Although Volkswagen and Toyota’s revenue is the top of the list, Ferrari is the most profitable.

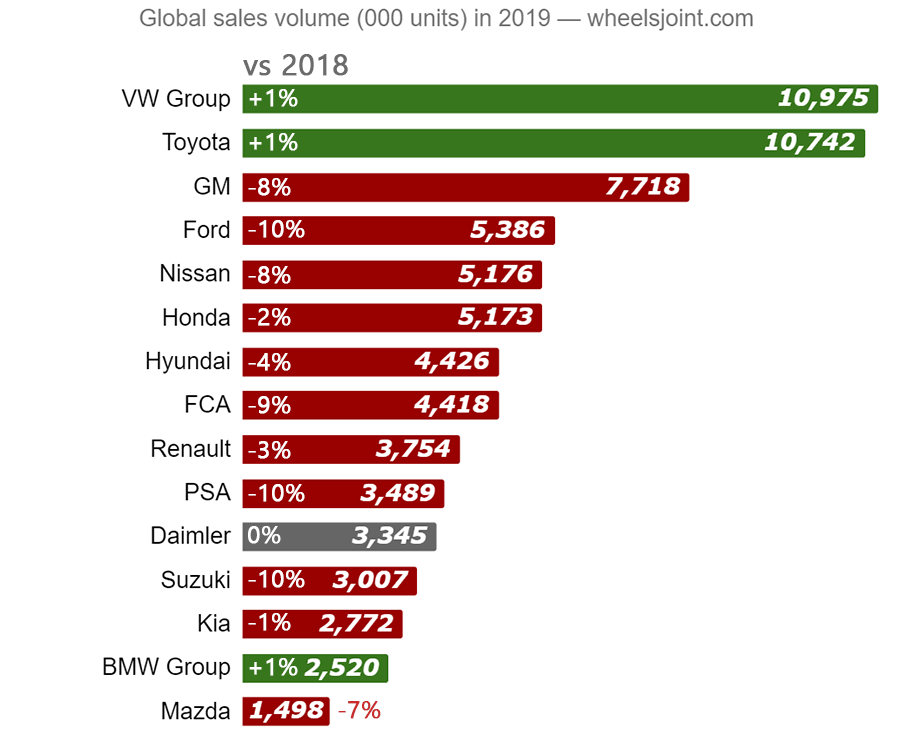

In terms of sales volume and revenue, the Volkswagen Group ranks first among the mainstream automakers in the world. In 2019, the Volkswagen Group sold 10.975 million vehicles, followed by Toyota with 10.742 million vehicles; Volkswagen’s revenue was 252.6 billion euros, while Toyota ’s reported revenue was 250.8 billion euros. Compared with 2018, the revenues of these two auto manufacturers have increased by 1% year-on-year, mainly due to the increase in delivery volume, the improvement of the price structure and the increase in the level of non-automotive business income.

In terms of profit, Toyota topped the list with an operating profit of 21.2 billion euros, a slight increase of 1% year-on-year, which means that the company’s per unit profit reached 1,976 euros, ahead of Volkswagen Group and its Japanese competitors (except Isuzu). Compared with other manufacturers, the turmoil in the external environment in 2019 did not have a negative impact on Toyota, which is partly due to the company’s hybrid vehicle lineup.

In terms of profitability, Ferrari won the crown. Last year, Ferrari sold a total of 10,131 vehicles, a record high; operating profit margin was as high as 23.2%, per unit profit exceeded 86,000 euros, equivalent to the profit of 30 BMW, 122 Renault and 926 Nissan cars. Ferrari’s rapid adoption of new technologies, its ability to adapt to market changes and its impressive marketing department made it through last year’s difficult times. More notably, the company achieved such results without SUV contributions.

Tesla is still an outlier, and the company adopts a business model that is different from many other competitors. The launch of Model 3 helped the brand expand its global influence and increase sales, but Model 3 is cheaper than other Tesla models, so the revenue level is not as good as others. At present, Tesla is in the expansion stage and is “burning a lot of money” to promote business growth. Therefore, although it has increased production and got out of “production hell”, it is still losing money. In 2019, Tesla’s net loss was 61.59 million euros, meaning that every car that was shipped actually lost 168 euros.

What will happen in 2020?

If the global environment is complex in 2019, then 2020 can be regarded as catastrophic. The pandemic of the coronavirus epidemic has caused more trouble than expected. In addition, European car manufacturers will also face penalties for excessive emissions, so most car companies will be struggling to have money by the end of the year.

Why are Hyundai and Kia counted separately and not combined, even though Hyundai owns Kia?

kewl Question!